#SingleFamilyZoning Part 3 - #Displacement

Often a concern raised around elimination of detached single-family zoning in exchange for a gentle-infill residential designation involves potential for displacement among homeowners who are households of color. As I noted earlier in this series, actual homeownership among communities of color is disproportionately smaller than white households. There are a myriad of reasons why, including historic redlining and lenders refusal to lend to households of color. Add in continued income disparities that have been rooted in institutional racism, and increased housing size for new construction, we know that households of color are less able to have access to homeownership, and ensuring those that have been able to can continue to do the same is very important as part of a broader equity approach to zoning and land use. Coming as a shock to no one, I’ll continue to cite to information gathered by the Seattle Planning Commission in their Neighborhoods for All Report, which is pretty great.

Broadly, as the argument goes, allowing more housing types in single-family areas allegedly will cause displacement in three ways:

Property taxes will go up so much that low- and fixed-income homeowners won’t be able to afford their taxes;

Property owners will be harassed so much that they will essentially acquiesce into selling to make the harassment stop; and

Households who rent detached single-family houses will lose their homes because landlords will sell them out.

The Property Tax Argument

Property taxes in Washington State are complicated. The argument around allowing more units-per-lot and the impact on property taxes appears to be that increasing in property value means an increase in annual tax liability for a property owner. But that isn’t how property taxes work. Rep. Drew Stokesbary (R-31) did a pretty excellent tweetstorm on the subject, and that whole thread can be found here.

At its most basic, actual year-over-year increases in property taxes see minimal change from assessed value increases. The most common cause of “significant” increases are voter-approved levy lid-lifts (and, in that one year, the “levy swap”). I put significant in quotes because it is relative. Where we regularly see renters grappling with $100+ per-month rent increases year-over-year, or $1,200 per year, often levy-lid-lifts in Seattle lead to an annual tax increase of less than 10% of that.

This isn’t to say that we should ignore the impacts of property tax increases on low- and fixed-income homeowners. Homeownership provides some of the greatest opportunity for housing stability. This is why I have long held the belief that “just because we can doesn’t always mean that we should” when it comes to the size of property tax levy-lid lifts. On the flipside, with new authority allowing local levy lid-lifts to be included in the senior property tax exemption provides additional ability to be more conscientious about the impacts on those few households that may be experiencing tax “burden.”

That said, the authorizing statute has its own problems. Most notable, it sets a hard income limit statewide, rather than relying on area median income. This creates a situation wherein households in lower-cost parts of the state receive greater benefit than those in areas like Seattle. Efforts to change this calculation to more accurately reflect regional variances in cost of living and levy-lid-lifts should be supported in Olympia to provide greater support to the relatively few households that have become equity-wealthy, but may not necessarily have liquid assets to keep up.

It should also be noted that in a situation wherein an individual opts to age-in-place in a modest detached single-family dwelling, and a few of their neighbors convert to allow for attached family dwellings, the assessed value of the additional improvements would likely lead to a situation where the value of the properties that have converted would increase at a higher clip, potentially leading to a decrease in property-tax liability for the household in a detached single-family house.

Property Owners Being Pressured to Sell

This is nothing new. We have heard reports across the region of speculators making offers on properties that aren’t listed, and concern that this level of pressure can lead to property owners giving in and selling. This has been reported to be especially true in areas where zoning changes have occurred, leading to people selling instead of transferring properties to their children, or other options that would allow for transfer of generational wealth.

Combating this is tricky at best. Disallowing repeated contacts via telephone and mail run up against First Amendment considerations, and fall outside of the scope of what a local jurisdiction can do with regard to regulating such conduct.

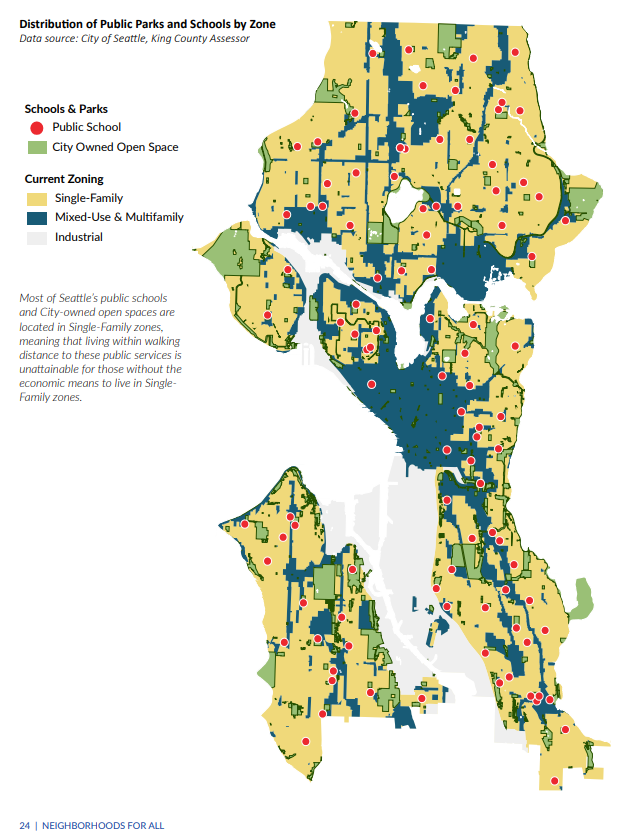

That doesn’t mean, however, that local jurisdictions are helpless in mitigating potential impacts of this type of property-poaching. For one, changes to detached single-family zoning to allow for greater housing diversity must be done intentionally, and rolled out in a way that centers equity in housing access. This could include beginning changes in areas that are high-opportunity and low-risk-of displacement, relieving some of the pressure in those markets that has caused increase pressure in communities of color.

Additionally, beefing up efforts to provide emergency home-repair and weatherization assistance to existing homeowners, along with increasing funding to expand land-trust homeownership opportunities with an attached housing model, can create more stability for households. Further, providing incentives and low-cost grants (in exchange for an affordability requirement) targeting households most likely to be impacted by rising costs-of-living for accessory dwelling units can be used as a displacement mitigation tool, and a means to discourage predatory practices to target homeowners who may be at greatest risk of physical displacement.

Detached Single-Family Rentals

Just over 16% of detached-single family houses in our region are rental houses. Ranging from families that can’t afford to purchase to groups of friends packing-it-in, allowing attached-family dwellings throughout our city will likely lead to some of these rental units being replaced with attached housing.

Implementing strategies to ensure that households impacted by such a change would be vital for successful and equitable implementation of a plan to allow greater housing diversity throughout Seattle. However, disallowing attached family dwellings altogether effectively drives up the rental costs for detached single-family homes, which is much more likely to economically displace low- and moderate-income households. We’re already seeing this, with groups of friends renting out houses together, removing limited family-size housing from the market as costs increase exponentially.

And the concept of allowing attached family housing doesn’t exclusively mean tearing down and building brand new structures. Councilmember O’Brien at one point floated the concept of allowing existing detached houses be converted to triplexes, and any plan to allow greater housing diversity throughout the city could include some level of incentive for conversions rather than teardowns, which not only could mean more family-size rental units near schools and parks, but also provide opportunity for seniors to “split” their houses, and age-in-place with a smaller square internal square footage to maintain.

In Sum

Displacement is happening. That is a simple fact. And it is happening at a disproportionate rate for communities of color, largely due to historic redlining, current lending practices, and continued disinvestment and lack of equal (much less equitable) access to jobs and opportunity.

Study after study has shown that there is a disparate impact of existing zoning and land use policies in the city on communities of color, and the significant increases in housing costs over the years has driven out far too many moderate- and low-income families. We can embrace all of the bumper-sticker slogans we want, but actually implementing rent-stabilization measures, or funding public housing to the scale needed to not only reach the lowest income households, but also being to address middle-income housing access, will take years.

Looking within the framework of what is currently available, and with the policies that can currently be implemented, changing detached single-family zoning to allow greater housing diversity in all parts of the city will be more of a displacement mitigation strategy than the current model of leaving things as they are. This is a sentiment shared by Ruby Holland, an MHA critic who, after acknowledging that MHA was going to happen, noted that more communities - in particular those that have been untouched for years by zoning changes that would allow more neighbors - must also participate in absorbing growth in our city:

From the Seattle Times

Ruby’s point is the point I have heard time and again: the historic impacts of development have been unequal, and if we are truly going to be a city that makes land-use and zoning choices through a racial equity lens, then we all must share in growing.

Part 1 of this series can be found here.

Part 2 of this series can be found here.